3 Simple Techniques For Top 30 Forex Brokers

3 Simple Techniques For Top 30 Forex Brokers

Blog Article

What Does Top 30 Forex Brokers Do?

Table of ContentsThe Main Principles Of Top 30 Forex Brokers The Ultimate Guide To Top 30 Forex BrokersThe Basic Principles Of Top 30 Forex Brokers The Definitive Guide to Top 30 Forex BrokersThe Ultimate Guide To Top 30 Forex BrokersSome Of Top 30 Forex BrokersThe smart Trick of Top 30 Forex Brokers That Nobody is Talking About

Check out on to discover the foreign exchange markets, what they're utilized for, and just how to start trading. The fx (foreign exchange or FX) market is a global industry for trading national currencies. Because of the worldwide reach of profession, business, and money, forex markets tend to be the globe's biggest and most liquid property markets.This suggests that all transactions happen through computer system networks among traders around the world rather than on one central exchange. The market is open 24 hours a day, five and a fifty percent days a week.

Top 30 Forex Brokers - Questions

You'll often see the terms FX, foreign exchange, international exchange market, and currency market. These terms are associated, and all refer to the foreign exchange market.

In the past, the foreign exchange market was controlled by institutional companies and big banks, which acted on part of clients. Yet it has actually become a lot more retail-oriented in current yearstraders and investors of all sizes join it. An interesting element of globe forex markets is that no physical structures operate as trading locations.

Top 30 Forex Brokers Fundamentals Explained

The forwards and futures markets have a tendency to be more preferred with companies or financial companies that need to hedge their international exchange risks out to a certain future date.

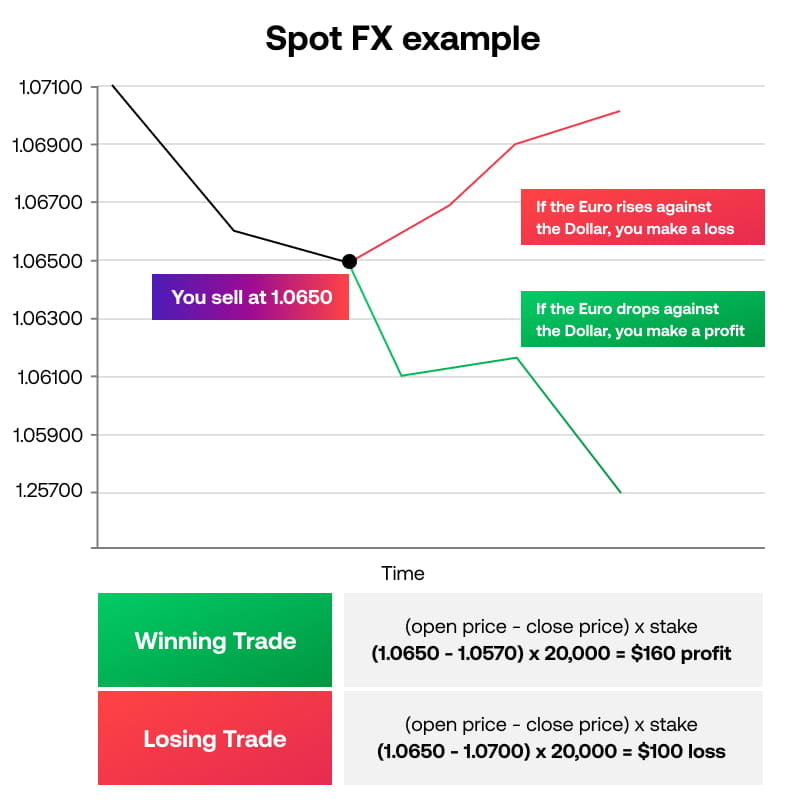

After a position is closed, it is worked out in money. The area market is commonly understood as one that deals with transactions in the existing (rather than in the future), these trades take 2 days to clear up. A forward contract is a personal contract between two parties to purchase a money at a future date and an established rate in the OTC markets.

Top 30 Forex Brokers Things To Know Before You Get This

A futures contract is a standardized agreement in between two celebrations to take distribution of a money at a future day and a predetermined rate. Futures trade on exchanges and not OTC. In the futures market, futures contracts are dealt based on a standard dimension and settlement date on public products markets, such as the Chicago Mercantile Exchange (CME).

These markets can supply defense against threat when trading money. Along with forwards and futures, choices contracts are traded on particular currency sets. Foreign exchange choices offer owners the right, but not the commitment, to participate in a forex profession at a future day. There are 2 distinct functions of money as an property course: So, you can benefit from the distinction between two interest rates in two various economic climates by acquiring the currency with the higher rate of interest and shorting the money with the reduced rate of interest.

Some Known Factual Statements About Top 30 Forex Brokers

An investor preparing for cost movement could short or long one of the currencies in a set and take advantage of the movement. Trading foreign exchange resembles equity trading. Below are some actions to obtain started on the foreign exchange trading journey.: While it is not made complex, foreign exchange trading is an undertaking that calls for specialized knowledge and a dedication to knowing.

7 Easy Facts About Top 30 Forex Brokers Described

: Accounts that allow you to trade as much as $10,000 worth of currencies in one lot.: Accounts that enable you to trade as much as $100,000 well worth of currencies in one lot.: An ask (or provide) is the lowest price at which you are eager to acquire a currency.: A proposal - https://qc0x1hvhrlr.typeform.com/to/JXe9Mi4f is the price at which you want to offer a money

One of the most standard types of foreign exchange trades are long and brief trades, with the price changes reported as pips, points, and ticks. In a lengthy trade, the investor is wagering that the currency price will increase and that they can benefit from it. A short trade contains a wager that the currency pair's rate will decrease.

Top 30 Forex Brokers for Dummies

Report this page